MARCH 2025

REAL ESTATE MARKET UPDATE

CONTACT US:

425-236-6777

Home Prices Hit All-Time High For The 19th Month In A Row

The housing market has experienced 19 consecutive months of positive growth as of December, shaping the landscape for both buyers and sellers. February’s market data reveals that home prices have continued their upward trend, though interest rates remain a key factor in affordability. A deeper dive into the broader economic picture, including a 10-year historical analysis, provides context for these shifts. By examining past trends, buyers and sellers can make informed real estate decisions based on data-driven insights.

Since 2020, national home prices have increased by 8.8% annually, with states like Florida, North Carolina, and Arizona leading the charge. While price growth remains strong, it has cooled significantly from the 2021 peak of 18.9%. The Federal Reserve’s aggressive mortgage-backed securities purchases helped push interest rates as low as 2.5%, fueling a housing boom. However, after the Fed stopped buying these securities in 2022, bond values declined, causing mortgage rates to spike to nearly 8% before finding some stability.

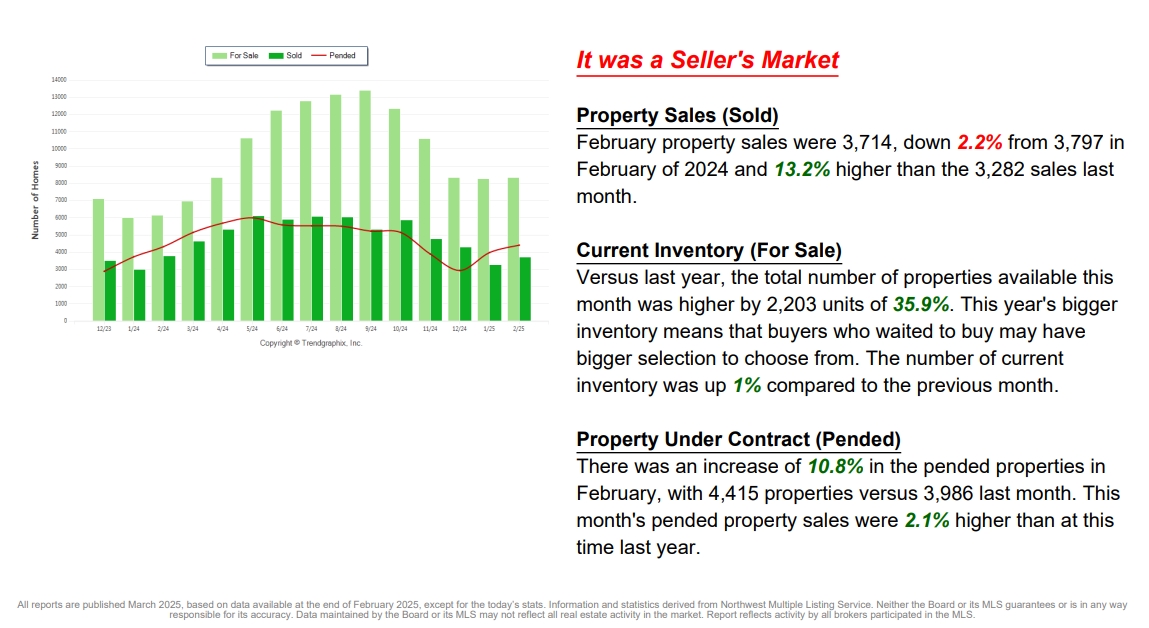

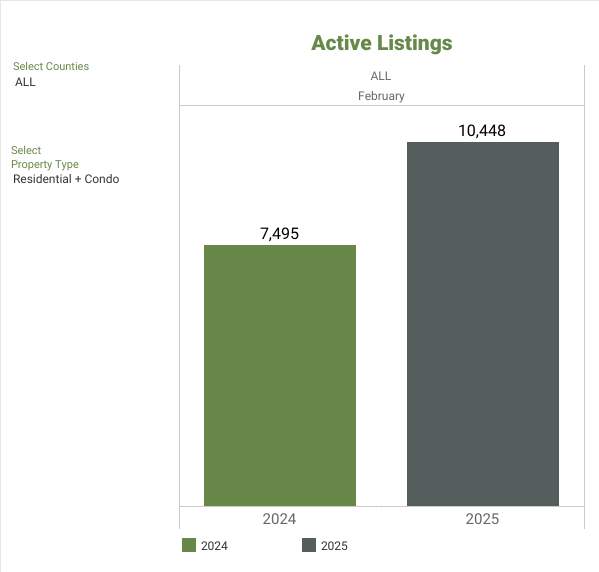

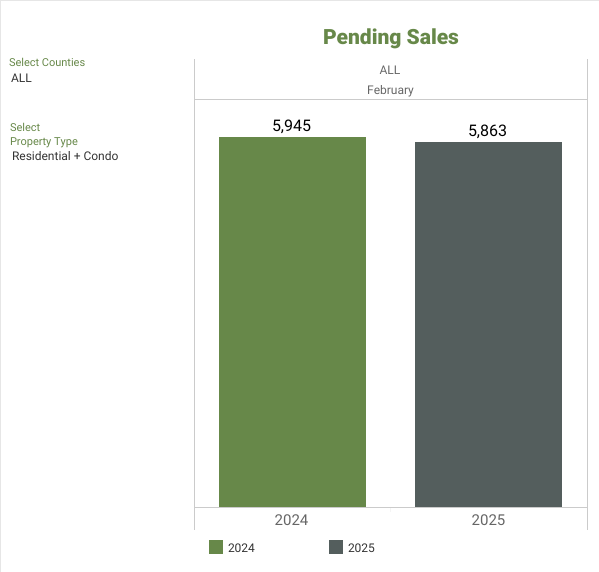

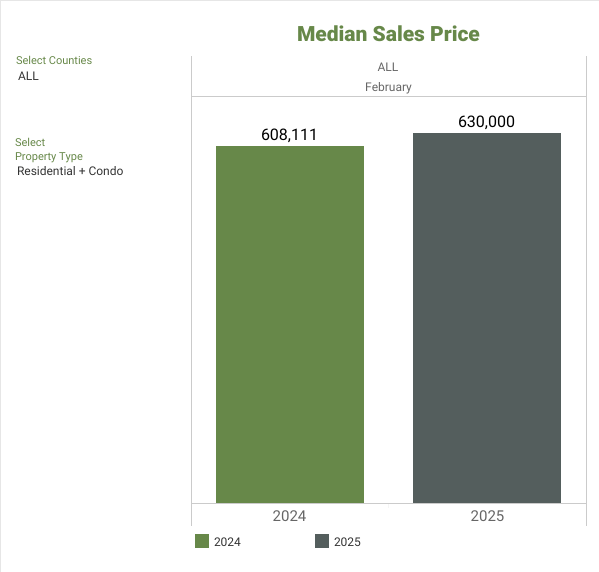

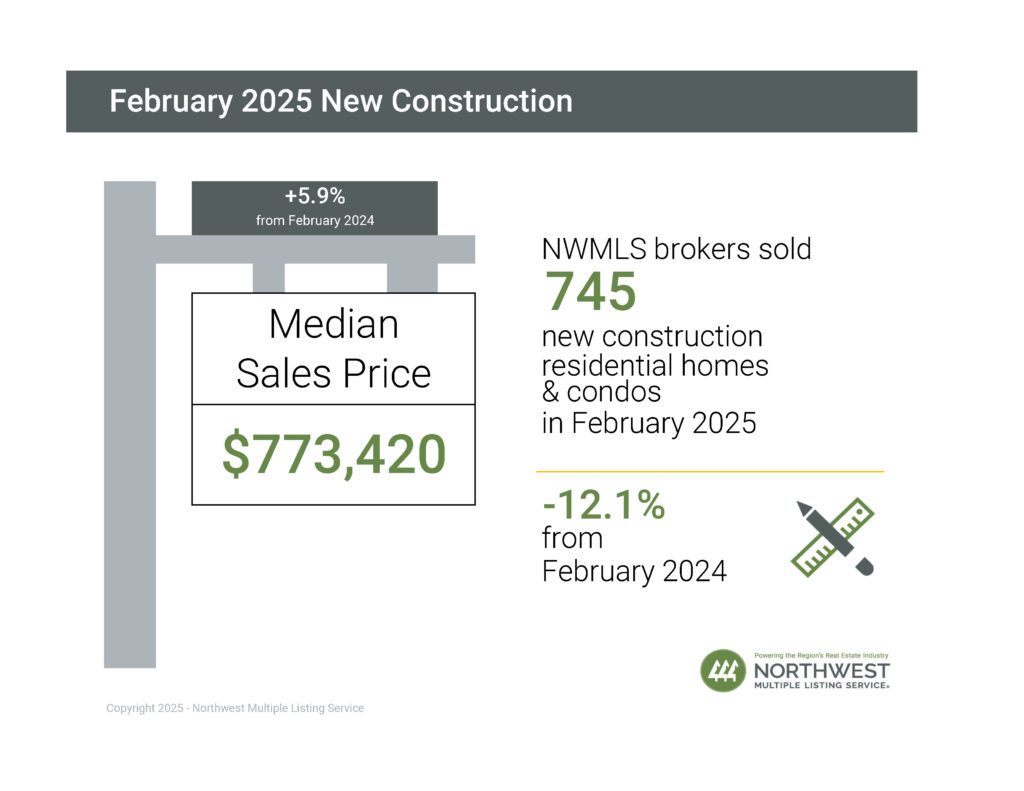

Seattle’s real estate market has mirrored national trends, with a 5.61% year-over-year price increase in December but a slight month-over-month dip due to rising interest rates. Nationally, the Case-Shiller Index indicates steady annual growth, though regional variations persist. Inventory levels in the Northwest MLS have grown as new listings enter the market, yet demand remains strong, outpacing supply in many areas. Mortgage rates continue to influence buying decisions, as new home sales have dropped 10.5% nationwide, affecting overall market momentum.

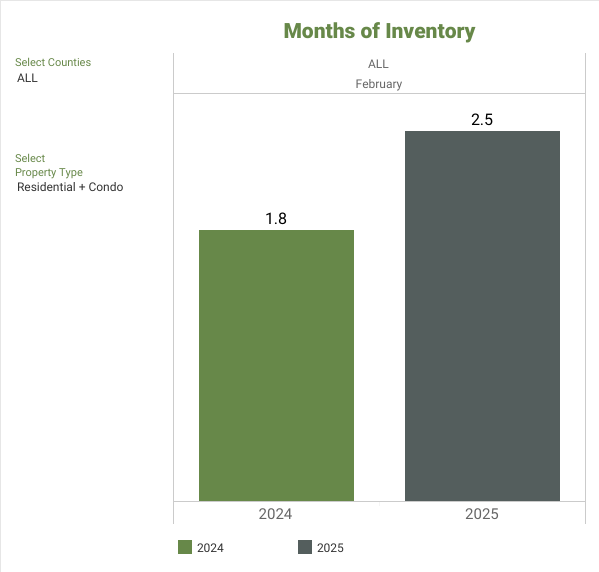

Understanding real estate seasonality is crucial, as spring typically brings an increase in available inventory. Mortgage rates are trending downward toward 6.5%, renewing buyer interest and encouraging refinancing opportunities. February’s data highlights a 34% rise in inventory and a 10% increase in pending home sales, pointing to an active market ahead. A 10-year historical analysis suggests that recent trends align with traditional seasonal patterns, except for anomalies during 2020-2022, making this an opportune time for strategic real estate moves.

The housing market has experienced 19 consecutive months of positive growth as of December, shaping the landscape for both buyers and sellers. February’s market data reveals that home prices have continued their upward trend, though interest rates remain a key factor in affordability. A deeper dive into the broader economic picture, including a 10-year historical analysis, provides context for these shifts. By examining past trends, buyers and sellers can make informed real estate decisions based on data-driven insights.

Since 2020, national home prices have increased by 8.8% annually, with states like Florida, North Carolina, and Arizona leading the charge. While price growth remains strong, it has cooled significantly from the 2021 peak of 18.9%. The Federal Reserve’s aggressive mortgage-backed securities purchases helped push interest rates as low as 2.5%, fueling a housing boom. However, after the Fed stopped buying these securities in 2022, bond values declined, causing mortgage rates to spike to nearly 8% before finding some stability.

Seattle’s real estate market has mirrored national trends, with a 5.61% year-over-year price increase in December but a slight month-over-month dip due to rising interest rates. Nationally, the Case-Shiller Index indicates steady annual growth, though regional variations persist. Inventory levels in the Northwest MLS have grown as new listings enter the market, yet demand remains strong, outpacing supply in many areas. Mortgage rates continue to influence buying decisions, as new home sales have dropped 10.5% nationwide, affecting overall market momentum.

Understanding real estate seasonality is crucial, as spring typically brings an increase in available inventory. Mortgage rates are trending downward toward 6.5%, renewing buyer interest and encouraging refinancing opportunities. February’s data highlights a 34% rise in inventory and a 10% increase in pending home sales, pointing to an active market ahead. A 10-year historical analysis suggests that recent trends align with traditional seasonal patterns, except for anomalies during 2020-2022, making this an opportune time for strategic real estate moves.

NWMLS Market Snapshot - FEBRUARY 2025

George Moorhead of Bentley Properties talks about Inflations Causing Rates To Go Up and Is The Real Estate Market Crashing? Plus, Top 5 Things You Need To Look For When Getting Mortgage Rates